How Media Rewards Works: Prize Draws

Discover how Media Rewards transforms your streaming time into valuable rewards. Join the Monthly Prize Draw for more chances to win simply by watching TV and streaming their favorite content.

Important Disclaimer: The content of this article is intended to convey general information. It should not be relied upon as financial advice.

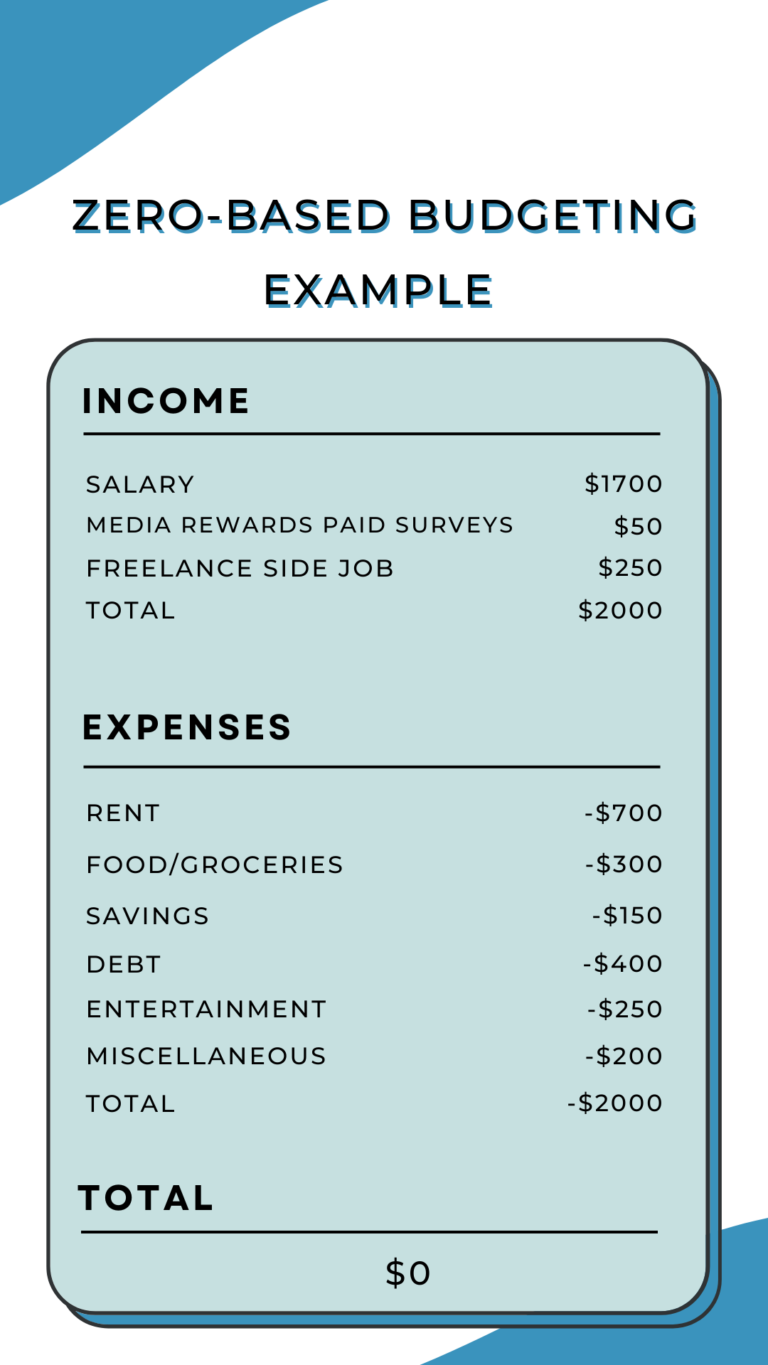

In a nutshell, Zero-Based Budgeting is a budget method that consists of allocating every part of your income (including your extra side income) to an expense. The biggest advantage of this method? There is small or no room for unnecessary expenses, which will make your financial life much more organized. For example, if you earn $4,000 a month, your expenses should be exactly $4,000. How? Keep reading and discover how Media Rewards survey app will help you.

Now that you have listed all your sources of income, you should allocate the corresponding amount for each item on your list.

Total: $2,000

Similarly to the process you did with listing your income, the same should be done with the expenses, so this means that each expense should have a fixed number.

Total: $2,000

Once you are finished, you should have a total amount of $0 left. This means, for example, that after completing your list, if you have a certain amount of money left, it is time to allocate it to a certain category. At Media Rewards, we are all about savings and good deals, so this extra number would then be fit for the “Savings” category.

Having a Zero-Based Budgeting doesn’t mean ending your month with zero dollars in your bank account. On the contrary, it means that all your earnings are correctly allocated and that unnecessary spending is less prone to happen.

Also, the “Miscellaneous” category would then be used for unexpected spending. For example, if your car breaks down, and you need to pay the mechanic to fix it up.

By using the Zero-Based Budgeting method, you will have more control over your finances. Additionally, you will better visualize your income and expenses while enjoying more of your time with things you enjoy.

Media Rewards survey app has premium paid surveys and holds monthly prize draws, allowing you to have an extra side income. With these, you can extend your budget for the “entertainment” category or anything else rocking your boat. Check where you can use our gift cards and get inspired.

Looking for more ways to organize your finances? Don’t miss our blog articles on “The 70-10-10-10 Budget Method” and “ The 30-Day Rule Method “.

Discover how Media Rewards transforms your streaming time into valuable rewards. Join the Monthly Prize Draw for more chances to win simply by watching TV and streaming their favorite content.

Learn 5 essential tips to maximize your rewards with the Media Rewards app. Turn media time into prizes and rewards!

Discover why Media Rewards is a legit survey app that lets you earn rewards passively while watching TV and streaming. Learn about privacy protection, real rewards like Amazon gift cards, and more in our in-depth review.

Earn gift cards effortlessly with Media Rewards, your trusted app. Watch your favorite shows and exchange points for Amazon, Walmart, and Starbucks gift cards. Download now!

Media Rewards, a survey and rewards app, is designed with stringent privacy measures to ensure your data remains secure while you earn rewards effortlessly. This blog post delves into the comprehensive privacy policies of Media Rewards, highlighting how your data is handled and protected.

Have you ever imagined transforming your usual streaming time into rewards? With Media Rewards you can start earning points that translate into gift cards and prize draw entries.